The Invoice object in Cloudy Business Ops 360 represents a formal billing document issued to a customer for goods sold or services rendered. It records the financial obligation of the customer, the payment terms, and the total amount due.

Invoices are a critical part of the Order-to-Cash process — they serve as the official request for payment and link directly to related transactions such as Sales Orders, Quotes, and Payments.

Use of Invoice in Cloudy Business Ops 360

- Billing & Accounting: Provides a formal record of charges and ensures proper revenue recognition.

- Payment Tracking: Helps track the amount due, payments received, and outstanding balances.

- Legal Documentation: Acts as a legally binding document for customer transactions.

Financial Reporting: Facilitates better financial forecasting, revenue reporting, and credit control. - Customer Experience: Offers clear communication to customers regarding charges, due dates, and payment methods.

Checkbox Functionality

Adding checkbox fields can improve operational workflows for invoicing.

| Checkbox Field | Purpose |

| Is Recurring Invoice? | Identifies whether the invoice is part of a recurring billing cycle. |

| Is Overdue? | Automatically checked when the due date passes and payment is not fully received. |

| Payment Reminder Sent? | Indicates whether a reminder has been sent to the customer. |

| Fully Paid? | Marks invoices as fully paid once the total paid amount matches the invoice total. |

| Credit Applied? | Marks when credit notes have been applied to this invoice |

Example Workflow

- Generate Invoice – System creates invoice from Sales Order or Quote.

- Review & Approve – Accounting reviews, sets Status to Issued.

- Send to Customer – Share via email with Payment Link.

- Track Payments – Apply payments as they are received.

- If full payment is done → check Fully Paid? and update status.

- If partial payment is done → keep status as Partially Paid and track balance.

- If full payment is done → check Fully Paid? and update status.

- Follow-Up – Use Is Overdue? and Payment Reminder Sent? to manage collection efforts.

Invoice Creation

Invoices can be automatically generated from either Quotes or Sales Orders, depending on the default field mapping configuration set under the Legal Entity.

This ensures data consistency across the sales-to-invoice process.

i. Quote Line To Invoice Line Settings

| Quote Line | Invoice Line |

| Item | Item |

| Unit Price | Unit Price |

| Quantity | Quantity |

| Item Variant | Item Variant |

| Sort Order | Sort Order |

| Record Id | Quote Line Item |

| Tax Rate | Tax Rate |

| Tax % | Tax % |

| List Price | List Price |

| Customer Discount % | Customer Discount % |

| Customer Discount Amount | Customer Discount Amount |

| Customer Discount Type | Customer Discount Type |

| Trade Discount% | Trade Discount% |

ii. Sales Order Line To Invoice Line Settings

| Sales Order Line | Invoice Line |

| Unit Price | Unit Price |

| Quantity Ordered | Quantity |

| Item | Item |

| Item Variant | Item Variant |

| Sort Order | Sort Order |

| Record Id | Sales Order Line Item |

| Tax Rate | Tax Rate |

| Tax % | Tax % |

| List Price | List Price |

| Customer Discount % | Customer Discount % |

| Customer Discount Amount | Customer Discount Amount |

| Customer Discount Type | Customer Discount Type |

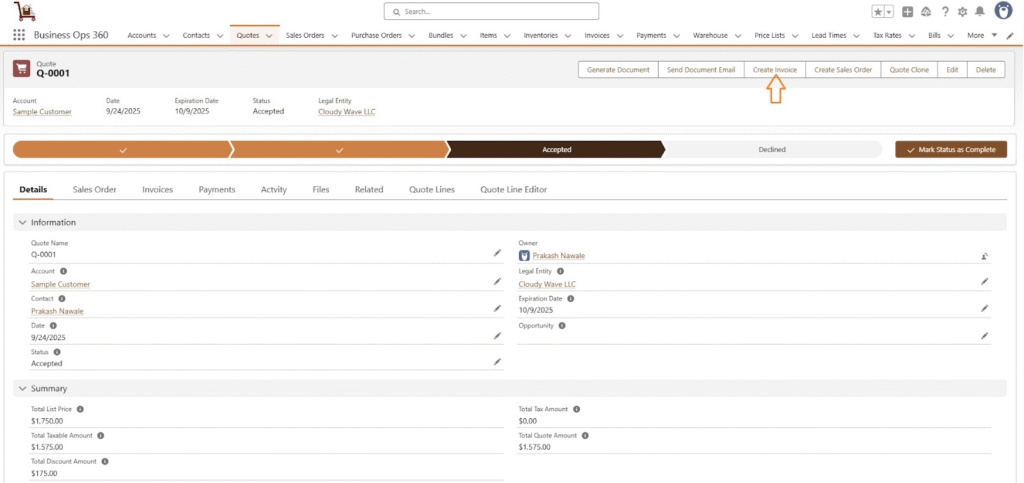

- From Quote

From Quote Tab ⇒ Select ‘Create Invoice’ action button on top right as below screenshot.

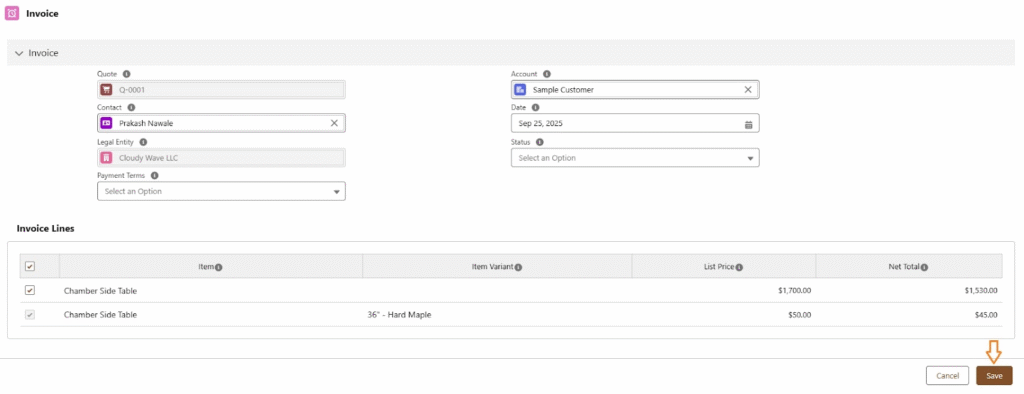

After clicking the Create Invoice action button, an invoice with its invoice lines is generated and displayed in the Invoice form. Finally, click Save to confirm.

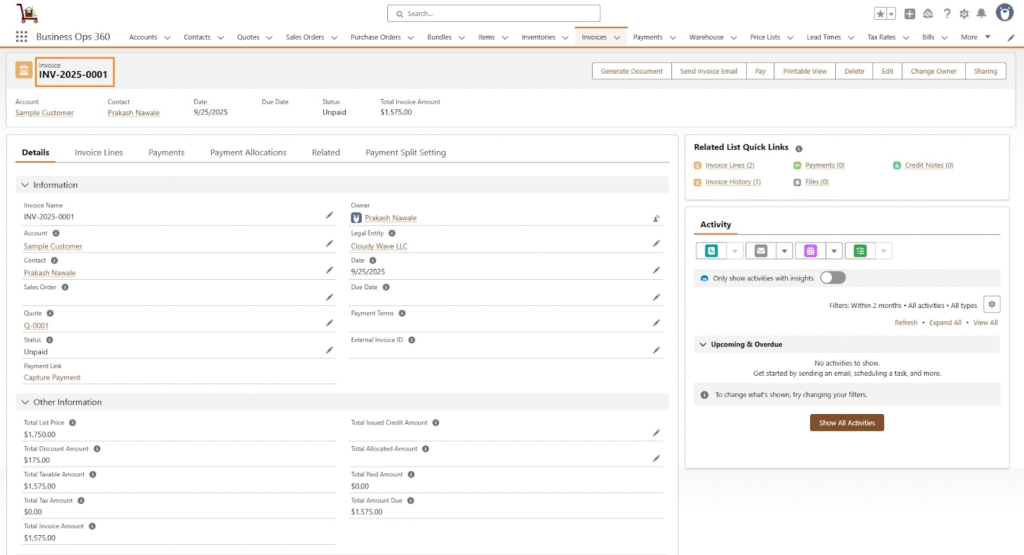

Once click on “Save”, Invoice is created as follows,

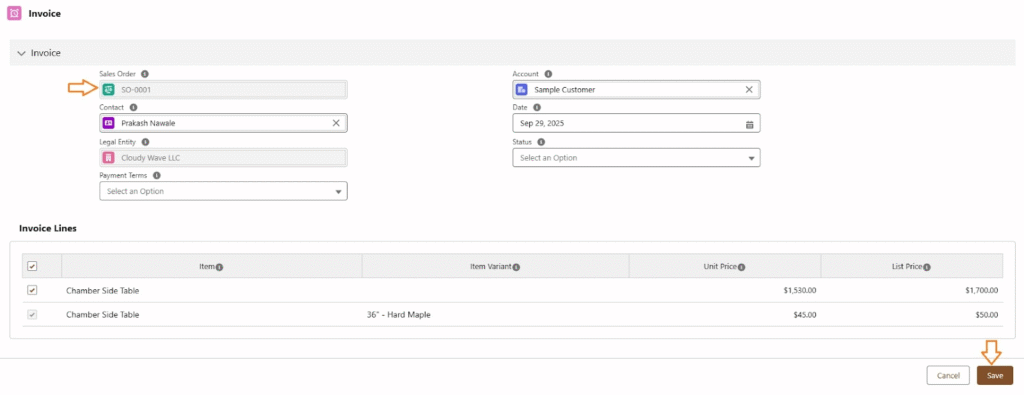

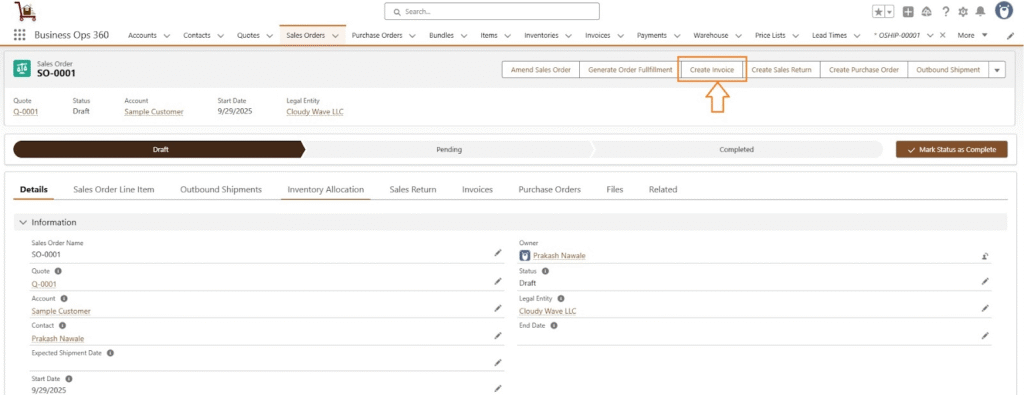

2. From Sales Order

From Sales Order Tab ⇒ Select ‘Create Invoice’ action button on top right as below screenshot.

After clicking the Create Invoice action button, an invoice with its invoice lines is generated and displayed in the Invoice form. Finally, click Save to confirm.